A topic of ongoing concern throughout the current COVID-19 pandemic has been the impact on businesses and as a consequence, the economy. Whilst JobKeeper, rent relief and other measures are assisting businesses in staying afloat and planning their next steps, what happens when these measures come to an end?

Unfortunately, it is inevitable that some businesses won’t survive – more so than usual given the current economic climate and uncertainty. The Federal Government is planning ahead, announcing insolvency reforms to assist businesses moving forward.

The announcement, made by Treasurer Josh Frydenberg and Assistant Treasurer Michael Sukkar on 24 September, foreshadows the most significant reforms to insolvency law in three decades.

What are the changes?

Details provided to date include:

- introducing a new debt restructuring process for incorporated businesses with liabilities of less than $1 million

- transitioning to a more flexible “debtor in possession” model so that eligible small businesses can restructure existing debts whilst remaining control of their business

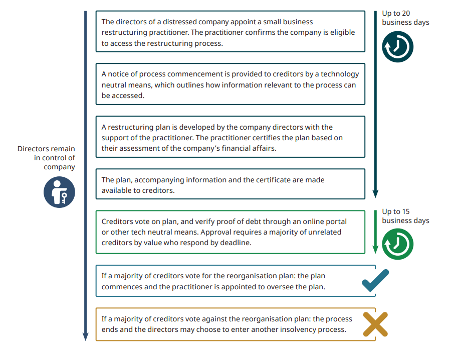

- implementing 20 business day period for the development of a restructuring plan by a small business restructuring practitioner. Creditors will then have 15 businesses days to vote on the plan (more than 50% must endorse the plan for it to proceed)

- establishing a new, simplified liquidation pathway for small businesses

- introducing complementary measures to assist in responding to increased demand and better meet the needs of small business.

The flowchart below provides a clear overview of the future restructuring process and timing:

Source: Treasury

When will the reforms come into effect?

The reforms will take place from 1 January, 2021, subject to the passing of legislation.

What will the impact be on businesses?

Modelled on key features of the United States’ Bankruptcy Code, the reforms will apply to approximately three-quarters of businesses currently subject to insolvencies (predominantly small businesses).

The reforms will enable businesses experiencing financial difficulties to the point of insolvency greater efficiencies in restructuring or winding up their operations, including paying employers and creditors. They aim to simplify the process and reduce time and costs for small businesses who may have already incurred further debts trying to stay afloat during the pandemic.

A useful fact sheet has been published by Treasury. Alternatively, if you would like more information on how the insolvency reforms may apply to your business, please contact me on 0402 136 083 or emacfarlane@macfarlane.law